What is Fast Food Delivery Insurance?

How our process works

We’ve worked hard to refine our process and keep it as quick, easy and simple as possible for our customers.

What Is Included With Food Delivery Driver Insurance?

Insurance for fast food delivery drivers is designed to cover a wide range of risks associated with food delivery. Exact cover may vary depending on insurance broker and you will need to discuss your requirements with the broker to ensure you have the right cover.

Who Needs Food Delivery Driver Insurance?

Anyone who delivers food for a living using their own vehicle will require food delivery driver insurance.

With the rise of Uber Eat and Just Eat services, there has never been more deliver drivers out there who require insuring. The value of the food you are delivering may not be that expensive but the risk to others whilst you operate remains high.

Getting Cheap Fast Food Insurance

We work with a large number of brokers who have access to a wide panel of schemes. They will be able to look at your risk and find you a policy that is right for you.

If you have a high claims history, then finding cheap fast food delivery insurance may not be so easy. That said, if you have a good claims history and show yourself to be a responsible driver, then your chances are good.

Frequently Asked Questions

Related News

The Benefits Of Courier Breakdown Cover

Courier breakdown cover in the is a specialized form of insurance tailored to meet the unique needs of courier and delivery drivers. These self-employed couriers and courier fleet companies rely heavily on their vehicles

The Benefits of Telematics Insurance: A Comprehensive Guide

Telematics insurance, also known as black box insurance, is revolutionising the way individuals and businesses manage their vehicle operations. By leveraging technology that monitors driving behaviour and vehicle usage, telematics insurance offers a range

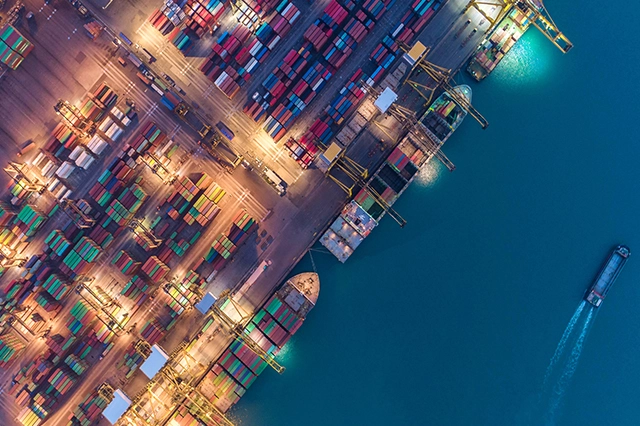

Transport and Logistics Trends Affecting 2024

The transport and logistics sector is on the cusp of a transformative year in 2024, influenced by a blend of technological advancements, sustainability efforts, and strategic industry shifts. Here’s a comprehensive look into the