What is Goods In Transit Insurance?

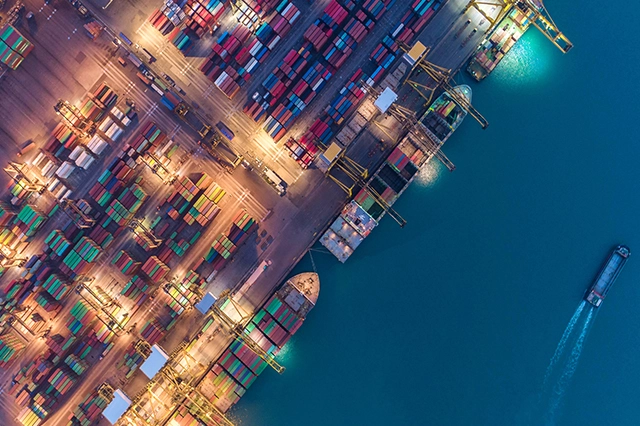

Goods in transit insurance (often shortened to GIT) is a type of insurance policy that provides cover for loss, damage or theft of goods while they are being transported from one location to another. This type of insurance is designed to protect businesses and individuals who transport goods as part of their regular operations, such as couriers, hauliers, and freight forwarders.

The cover provided by goods in transit insurance typically includes a range of risks, such as accidental damage to goods, theft, loss, and damage caused by fire or other perils. Policies can be tailored to suit the specific needs of the business, and can provide coverage for a single trip, or for a set period of time.

It is important to note that not all goods are automatically covered by goods in transit insurance, and there may be exclusions or limitations to the cover. Therefore, it is important to carefully review the policy terms and conditions to ensure that the coverage meets the needs of the business.

How our process works

We’ve worked hard to refine our process and keep it as quick, easy and simple as possible for our customers.

Who needs Goods in Transit Insurance?

Goods in Transit Insurance is typically needed by businesses or individuals who transport goods as part of their regular operations. This can include couriers, hauliers, freight forwarders, and any other business that needs to move goods from one place to another.

Goods in Transit Insurance is particularly important for businesses that transport high-value items, or items that are particularly susceptible to damage or theft. Without adequate insurance, these businesses could be left with significant financial losses if something goes wrong.

What does Goods in Transit Insurance cover?

Insurance for goods in transit typically provides cover for loss or damage to goods while they are in transit. The level of cover can vary depending on the policy and the needs of the business or individual. On your goods in transit quote though, you should look to include.

- Accidental damage: This covers damage to goods that occurs during transport such as if they are dropped, crushed or otherwise damaged.

- Theft: This protects against loss of goods due to theft or burglary whilst in your car.

- Fire & other perils: This covers damage to goods that occurs due to events such as fire, explosion, and natural disasters.

- Public liability: This covers the public for loss or damage caused by your activity.

It is important to carefully review the goods you’ll be carrying and where you will be carrying them to. If you under insure and have an accident, you will be liable for the costs incurred.

What are the benefits of having Goods in Transit Insurance?

There are several benefits to having Goods in Transit Insurance, including:

- Protection against financial loss: Goods in Transit Insurance provides cover in the event of loss or damage to goods during transport, which can help protect businesses and individuals from financial losses.

- Compliance with legal and contractual requirements: In some cases, Goods in Transit Insurance may be required by law or by contractual obligations with clients or customers.

- Increased customer confidence: Having Goods in Transit Insurance can help businesses demonstrate to customers that they take the safe transport of goods seriously, which can increase confidence in their services.

- Flexibility: Goods in Transit Insurance can typically be tailored to meet the specific needs of the business or individual.

- Peace of mind: Knowing that goods are covered by insurance during transport can provide peace of mind for businesses and individuals, allowing them to focus on their core activities without worrying about the potential financial impact of lost or damaged goods.

Are there any exclusions to Goods in Transit Insurance coverage?

Yes, there are usually exclusions to Goods in Transit Insurance cover that will be specified in the policy terms and conditions. The specific exclusions can vary depending on the policy and the insurer, but some common exclusions may include:

- Deliberate damage: Goods in Transit Insurance typically does not cover loss or damage that occurs as a result of deliberate actions by the insured or their employees.

- Wear and tear: Normal wear and tear that occurs during transport is generally not covered by Goods in Transit Insurance.

- Inadequate packaging: If goods are not properly packaged for transport and this results in damage, the insurer may not provide coverage.

- War and terrorism: Some policies may exclude coverage for loss or damage that occurs as a result of war or acts of terrorism.

- Consequential loss: Goods in Transit Insurance typically only covers the value of the goods themselves, and does not provide coverage for any indirect or consequential losses that may result from the loss or damage of the goods.

Frequently Asked Questions

Related News

The Benefits Of Courier Breakdown Cover

Courier breakdown cover in the is a specialized form of insurance tailored to meet the unique needs of courier and delivery drivers. These self-employed couriers and courier fleet companies rely heavily on their vehicles

The Benefits of Telematics Insurance: A Comprehensive Guide

Telematics insurance, also known as black box insurance, is revolutionising the way individuals and businesses manage their vehicle operations. By leveraging technology that monitors driving behaviour and vehicle usage, telematics insurance offers a range

Transport and Logistics Trends Affecting 2024

The transport and logistics sector is on the cusp of a transformative year in 2024, influenced by a blend of technological advancements, sustainability efforts, and strategic industry shifts. Here’s a comprehensive look into the